profhimservice62.ru

Recently Added

Changing Car Insurance Companies

To change an existing policy, such as adjusting coverage limits or adding another driver, call your insurer's customer service number or speak with your local. I just bought my policy and now want to move it to another insurer, but I'. Drivers have many reasons for switching car insurance companies: cheaper rates, better coverage, a recent move, a new car purchase, and so on. As a policyholder, you are responsible for informing your insurer of any changes made to your vehicle or how it is used. This includes things like vehicle. Steps to Take When Changing Auto Insurance Companies · Things to Consider When Driving for a Ride Share Company · You've Just Been In A Car Crash. Now What. In this guide, we'll walk you through everything you need to know about changing car insurance providers. Switching car insurance doesn't have to be a headache. Learn the best way to change insurance companies and other FAQs around switching your auto policy. Yes! It is possible to change car insurance companies at any point in time after purchase. However, you must have a strong reason to back. Switching car insurance providers can result in lower rates and better coverage. Here are 7 things to know before switching car insurance companies. To change an existing policy, such as adjusting coverage limits or adding another driver, call your insurer's customer service number or speak with your local. I just bought my policy and now want to move it to another insurer, but I'. Drivers have many reasons for switching car insurance companies: cheaper rates, better coverage, a recent move, a new car purchase, and so on. As a policyholder, you are responsible for informing your insurer of any changes made to your vehicle or how it is used. This includes things like vehicle. Steps to Take When Changing Auto Insurance Companies · Things to Consider When Driving for a Ride Share Company · You've Just Been In A Car Crash. Now What. In this guide, we'll walk you through everything you need to know about changing car insurance providers. Switching car insurance doesn't have to be a headache. Learn the best way to change insurance companies and other FAQs around switching your auto policy. Yes! It is possible to change car insurance companies at any point in time after purchase. However, you must have a strong reason to back. Switching car insurance providers can result in lower rates and better coverage. Here are 7 things to know before switching car insurance companies.

Switching insurance companies does not invalidate the coverage you had for a previous policy period. You can still report a claim for damage that occurred. This post explains how to switch your car insurance company when you can change your auto insurance company and how to save money. Completing a defensive driving course from an MTO approved driving school could qualify you for a discount. 43) Don't Switch Insurers Mid Term. If you decide. The short answer is yes, you can change your insurance company, and your new insurance company will be obligated to cover your claim as long as your coverage. Considering a switch in car insurance companies? Follow this simple 3-step process · Shop for new rates at least 30 days before your renewal date. Typically. However, if you're saving a significant amount on the new policy, you may still come out ahead. What's the benefit of changing car insurance companies? There. Double-check potential extra costs. By giving proper notice, you'll generally be able to switch carriers in the middle of a coverage period. The carrier refunds. Your insurance company will cancel your old policy because every state has different coverage requirements and regulations. At Progressive, we have a team of. We protect your rights when purchasing automobile insurance and review your complaints if an insurer is not following the rules. You can switch insurance companies whenever you want. However, waiting until your policy renewal date is recommended to avoid paying mid-term cancellation. You purchase coverage from the new company, and schedule cancellation of the old policy the effective date of the new policy. 1. Gather information. Collect the information you'll need to get and compare car insurance quotes from several companies. You can switch your insurance company at any time. A good time to consider changing insurance companies is when your personal situation and needs change. There. Changing car insurance shouldn't be a long process. It can easily be broken down into three steps that can lead you to successfully switch car insurance. No, every insurance company is different. Some have substantial discounts for longevity and new companies may also give a discount for that as. Yes, you can switch car insurance after an accident, or any time you choose. You don't have to wait until your policy is up for renewal to switch car insurance. They will add them to your car insurance and inform you of any changes to your insurance premium, if any. © Copyright Intact Insurance Company. Modify your auto insurance policy; Change your address; Modify your annual mileage and usage habits; Add or change a vehicle on your insurance policy. Yes, you can switch car insurance at any time. It's usually easiest to switch car insurance companies at the time of your policy renewal. Switching car insurance companies isn't unusual, and it can be a wise, money-saving move. Industry premiums, your driving record, and the other factors in.

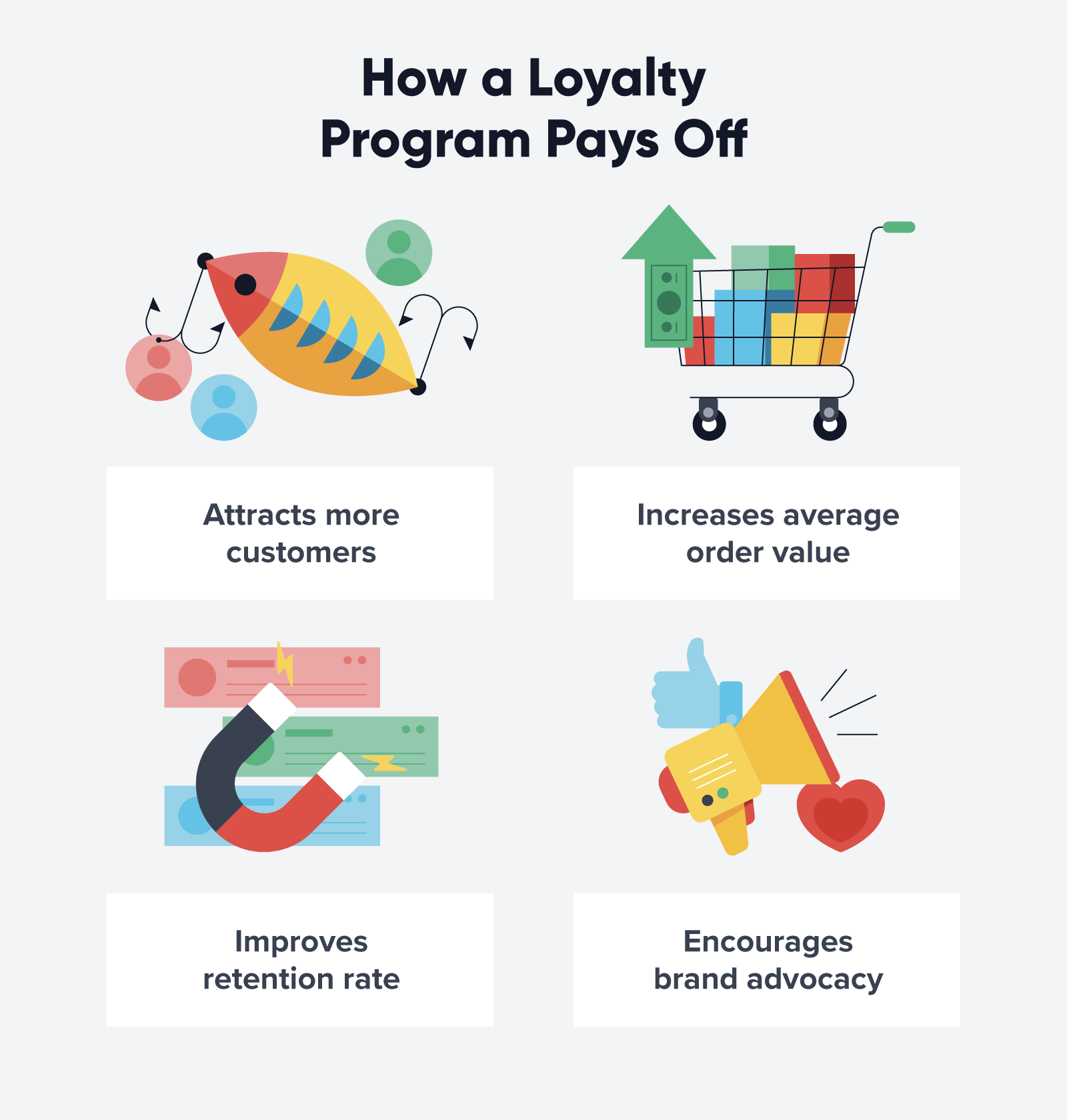

What Do Loyalty Programs Do

A good customer loyalty program can generate significant gains in recurring revenue for your business by improving the return on your marketing and sales. This program offers members points based on how much money they spend or what actions they take, such as leaving a review, rating a product, or signing up for. On the one hand, loyalty members buy more often and spend more than non-loyalty members, resulting in a % revenue increase. On the other hand, according to. Paid loyalty programs require members to pay for access to special services, discounts or unique opportunities – either monthly or yearly. These programs make. Customer loyalty programs use incentives, rewards, and personalized experiences to keep customers engaged, satisfied, and loyal to a brand or company. A loyalty program or a rewards program is a marketing strategy designed to encourage customers to continue to shop at or use the services of one or more. By definition, a customer loyalty program is a marketing approach that recognizes and rewards customers who purchase or engage with a brand on a recurring basis. A loyalty program encourages shoppers to visit a store more often. Those repeat visits earn the store more money than they give away in the form. A loyalty program is a reward initiative by a brand that provides its customers exclusive benefits based on their previous purchases. A good customer loyalty program can generate significant gains in recurring revenue for your business by improving the return on your marketing and sales. This program offers members points based on how much money they spend or what actions they take, such as leaving a review, rating a product, or signing up for. On the one hand, loyalty members buy more often and spend more than non-loyalty members, resulting in a % revenue increase. On the other hand, according to. Paid loyalty programs require members to pay for access to special services, discounts or unique opportunities – either monthly or yearly. These programs make. Customer loyalty programs use incentives, rewards, and personalized experiences to keep customers engaged, satisfied, and loyal to a brand or company. A loyalty program or a rewards program is a marketing strategy designed to encourage customers to continue to shop at or use the services of one or more. By definition, a customer loyalty program is a marketing approach that recognizes and rewards customers who purchase or engage with a brand on a recurring basis. A loyalty program encourages shoppers to visit a store more often. Those repeat visits earn the store more money than they give away in the form. A loyalty program is a reward initiative by a brand that provides its customers exclusive benefits based on their previous purchases.

At its core, a points rewards program involves customers performing an activity, earn points for completing that activity, and then after a certain amount of. A strong loyalty program encourages greater advocacy and can even reward customers for it. But it can also be unique selling point in itself, attracting. How their loyalty program works is customers earn “stars” for each purchase, and these stars can be redeemed for free drinks and food items. Users can also save. Increasing the lifetime value of a customer should always be an objective for any business, with or without a loyalty program. After all, it costs more to. A loyalty program or a rewards program is a marketing strategy designed to encourage customers to continue to shop at or use the services of one or more. What are ecommerce loyalty programs? An ecommerce loyalty program is a marketing strategy developed by ecommerce stores to nurture and reward their best. Customer reward programs are the point-based programs loyalty programs designed to increase customer engagement and purchases in exchange for discounts and. Paid loyalty programs require members to pay for access to special services, discounts or unique opportunities – either monthly or yearly. These programs make. A loyalty program collects unique zero- and first-party data that enables your brand to go beyond transactions. Engaging customers between purchases becomes. In times of economic uncertainty, there's less money to go around and higher levels of competition, meaning brands need to prove why customers should choose. Customer loyalty programs can be a rich source of useful data. From customer preferences, motivations, buying habits and more, you can gather a wealth of. Tiered loyalty programs are essentially beefed-up points programs that add elements of gamification, play on exclusivity and can introduce experiential benefits. Here at Mailchimp, curating customer loyalty is at the heart of everything we do. The history of modern commerce has proven the value of these systems again and. Since the value of any loyalty program lies in its ability to influence profitable customer behavior, knowing how the human brain perceives different scenarios. Speaking of a loyal customer base, this one is closely related to a high retention rate when occasional customers turn into loyal ones. A customer retention. In times of economic uncertainty, there's less money to go around and higher levels of competition, meaning brands need to prove why customers should choose. Send notifications to remind customers of their reward balances, or indicate what they need to do to reach the next reward tier. Leverage progress bars. It works on the basis of rewarding customers that choose to return and stay with the brand, increasing brand loyalty. Loyalty programs don't need to utilize. It works on the basis of rewarding customers that choose to return and stay with the brand, increasing brand loyalty. Loyalty programs don't need to utilize. To sum up, loyalty programs are an effective strategy for customer retention, business outreach, and holistic and sustainable business growth. Businesses can.

Cheapest Auto Loan Refinance Rates

Our auto loan rates are as low as % APR! 3 Plus, you could also earn up to % APY 4 when you combine your auto loan with a University Checking Account. Check out our auto loan refinance rates. · New Car Loan. As low as. %A P RAPR. on a month term Available for or newer models · Used Car Loan. As low. Want to refinance your car loan? Compare rates from top lenders, use our calculator to find your monthly payment and see exactly how much you can save. Auto Three-Fi™: Three perks for you · Up to $ cash back¹ · Rates as low as % APR² · 90 days to first payment³. Lower car payments are just a few clicks away! Get started. Rate as low as. %**. Average payment savings. $/month*. Car loans refinanced. ,+. Your. ²APR=Annual Percentage Rate. If you're refinancing your vehicle loan from another lender, we will give you the lowest of either a) your Columbia CU qualifying. Calculate your potential auto refinance savings. Use this auto refinance calculator to compare your current loan with a refinance loan. Rates as of Sep 06, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. NASA Federal Credit Union (NASA FCU) offers traditional and cash-out auto refinancing with low rates and flexible repayment terms ranging from one to seven. Our auto loan rates are as low as % APR! 3 Plus, you could also earn up to % APY 4 when you combine your auto loan with a University Checking Account. Check out our auto loan refinance rates. · New Car Loan. As low as. %A P RAPR. on a month term Available for or newer models · Used Car Loan. As low. Want to refinance your car loan? Compare rates from top lenders, use our calculator to find your monthly payment and see exactly how much you can save. Auto Three-Fi™: Three perks for you · Up to $ cash back¹ · Rates as low as % APR² · 90 days to first payment³. Lower car payments are just a few clicks away! Get started. Rate as low as. %**. Average payment savings. $/month*. Car loans refinanced. ,+. Your. ²APR=Annual Percentage Rate. If you're refinancing your vehicle loan from another lender, we will give you the lowest of either a) your Columbia CU qualifying. Calculate your potential auto refinance savings. Use this auto refinance calculator to compare your current loan with a refinance loan. Rates as of Sep 06, ET. Disclosures and Definitions Advertised “as low as” annual percentage rates (APR) assume excellent borrower credit history. Your. NASA Federal Credit Union (NASA FCU) offers traditional and cash-out auto refinancing with low rates and flexible repayment terms ranging from one to seven.

Get more with Bank of America auto refinance loans · day rate lock guarantee · No fee to apply for your refinance loan · Manage all your BofA accounts in one. Borrowers with excellent credit may be eligible for lower interest rates as low as 2 or 3% for a new vehicle. Occasionally dealerships will even offer a 0%. Auto Loan Refinancing ; Up to 48 Months, %, No minimum loan amount ; Up to 66 Months, %, $10, ; Up to 75 Months, %, $12, ; Up to 84 Months, %. Vehicle Loans. a group of people in a car. Auto, Boat, and RV. Easy loan application. Refi rates as low as % APR 1 for new vehicles. Plus, you could get a $ bonus when you refinance your auto loan from another lender. Purchase a New or Used Auto. Learn More · View Rates. % APR*, Up to 84 months**. No pre-payment penalty; Loan options for members who have experienced past. Fixed auto loan interest rates as low as % APR (OAC)1; Up to 90 days with Auto loan refinancing available. 1. APR=Annual Percentage Rate. Rates. Compare auto loan rates in September ; Carputty, Starting at %, 63 Months, $25,$,, Bankrate Award winner for best auto loan for used car. Current Rates Current Rates ; New Auto Loans · New Auto Loans · 48 Months ; Used Auto Loans · Used Auto Loans · 36 Months ; Boat & RV Loans · Boat & RV Loans · 48 Months. Refinancing your auto loan or mortgage with Georgia United Credit Union could help you save by lowering your monthly payment. Check out our low rates. Compare auto loan rates in September ; Consumers Credit Union, Starting at %, months, Not specified, Bankrate Award winner for best auto loan. Take a look at all of the current used vehicle interest rates in Canada. Pick the one you like and go through our quiz to find out if you pre-qualify. Want to see what your car payments might look like? Easily calculate your payment amount with our Car Loan Calculator and see how your interest rate, down. For Auto Refinancing Loans, APR ranges from % to %. APRs are determined at the time of application. Lowest APR is available to borrowers with excellent. Our low rates, flexible financing terms and quick and easy process can help lower your payment when refinancing your car. Apply for an Auto Loan now. Contact your dealer directly for more information. For the best rates. Our rates start at %* for qualified applicants. If you love the car you have, refinance your current auto loan at our low rate to reduce your monthly. Affordable new or used auto loans with competitive rates. Auto loan refinancing. Prequalify online. Finance directly at select dealerships while shopping.*. Best Overall: PenFed · Best for Bad Credit/Low Rates: AUTOPAY · Best Credit Union: Consumers Credit Union · Best for Refinance: LendingTree · Best for Fair. Simply input your loan information to learn how much you could save when you refinance. Refinance Calculator Car Loan Rates Compare Auto Loans. What.

Positive Psychology Course Harvard

The health experts at Harvard Medical School are proud to announce the creation of the exclusive Positive Psychology Course that reveals the easy-to-apply. This fully online accredited MA degree in Happiness Studies focuses on educating leaders who are committed to the cultivation of wellbeing in themselves and. Step-by-step, this powerful online course delivers a variety of research-proven techniques and shows you exactly how to put them into practice. Enroll Today. Positive Psychology is the scientific study of the factors that enable individuals and communities to thrive. The field is founded on the belief that people. Founded by Megan McDonough and Professor Tal Ben-Shahar, instructor for one of the most popular courses in the history of Harvard, WBI was one of the first. Yes, Harvard has an internationally recognized psychology program. According to Times Higher Education, Harvard is the 4th best university in. The interactive Positive Psychology Course makes it easy to understand and apply the how-to steps to help boost your long-term happiness and well-being. Free Online Positive Psychology Course From Coursera · An overview of the history of positive psychology · Positive psychology interventions and applications. Positive psychology is a branch of psychology focused on cultivating satisfaction and contentment on both an individual and community level. The health experts at Harvard Medical School are proud to announce the creation of the exclusive Positive Psychology Course that reveals the easy-to-apply. This fully online accredited MA degree in Happiness Studies focuses on educating leaders who are committed to the cultivation of wellbeing in themselves and. Step-by-step, this powerful online course delivers a variety of research-proven techniques and shows you exactly how to put them into practice. Enroll Today. Positive Psychology is the scientific study of the factors that enable individuals and communities to thrive. The field is founded on the belief that people. Founded by Megan McDonough and Professor Tal Ben-Shahar, instructor for one of the most popular courses in the history of Harvard, WBI was one of the first. Yes, Harvard has an internationally recognized psychology program. According to Times Higher Education, Harvard is the 4th best university in. The interactive Positive Psychology Course makes it easy to understand and apply the how-to steps to help boost your long-term happiness and well-being. Free Online Positive Psychology Course From Coursera · An overview of the history of positive psychology · Positive psychology interventions and applications. Positive psychology is a branch of psychology focused on cultivating satisfaction and contentment on both an individual and community level.

Harvard and Yale's “Positive Psychology” class is taught at Üsküdar University. Üsküdar Üniversitesi Positive Psychology, known as “Science of Happiness” aims. The Positive Psychology class taught by Ben Shahar attracts students per semester and 20% of Harvard graduates take this elective course. Positive emotions are linked with better health, longer life, and greater well-being. The Positive Psychology Course from #HarvardHealth. Positive Psychology: Harnessing the power of happiness, mindfulness, and inner strength is a guide to the concepts that can help you find well-being and. Tal Ben-Shahar teaches a course on Positive Psychology at Harvard. And it's apparently one of the most popular courses the university has ever offered. Through cutting-edge survey tools, the best research, and trends in social science, positive psychology, neuroscience, and philosophy, learners unlock the. The University of North Carolina at Chapel Hill's positive psychology course is one of the shorter free psychology courses available. Each enrollee should. This is a class that answers these questions and shows you how you can use the answers to build a happier life. Harvard Medical School publishes Special Health Reports on a wide range of topics. To order copies of this or other reports, please see the instructions at the. HARVARD'S POSITIVE PSYCHOLOGY Did you know that at Harvard, the most popular and successful course teaches you how to learn to be happier? The course focuses on the psychological aspects of a fulfilling and flourishing life. Topics include happiness, self-esteem, empathy, friendship, love. Did you know that at Harvard, one of the most prestigious universities in the world, one of the most popular and successful courses taught. PSY at Harvard University (Harvard) in Cambridge, Massachusetts. Why does it seem that some people are so resilient and content? This course looks at. In summary, here are 10 of our most popular positive psychology courses · Foundations of Positive Psychology · Positive Psychology · Positive Psychiatry and Mental. The health experts at Harvard Medical School are proud to announce the creation of Positive Psychology. This unique online course reveals easy-to-apply tools. Harvard 01 Positive Psychology · Harvard University 02 Positive Psychology · Harvard University 03 Positive Psychology Ben-Shahar's passion is teaching, and he goes on to explain how he teaches positive psychology. His Harvard course on the subject has been offered twice, in. notes in positive psychology at Harvard (Harvard professor of happiness prescription) [Paperback] by 王滟明;邹简 - ISBN - ISBN The Positive Psychology course at Harvard University focuses on the scientific study of human flourishing and well-being. Students will explore the theories and. This article is a case study of an undergraduate course in positive psychology taught by Dr Tal Ben-Shahar. The course has been taught three times between.

Best Company To Get A Mortgage With

Your best bet is a local lender. Ask your realtor for a recommendation. A local lender will make your offers more attractive because the local. Showing: Purchase, Good (), year fixed, Single family home, Primary residence. License information. 10 results: year fixed. The best mortgage lenders · Best for lower credit scores: Rocket Mortgage · Best for flexible down payment options: Chase Bank · Best for no lender fees: Ally Bank. You can also get a home loan through a mortgage broker. Brokers arrange transactions rather than lending money directly; in other words, they find a lender for. Churchill Mortgage is a trusted mortgage lender near you. They offer a certified home buyer program, so you close days sooner, job loss protection and. The more knowledgeable you are before you approach lenders, the better deal you're likely to get. find a mortgage lender and there is an extra fee for their. The 10 best mortgage lenders of August — and how to get their lowest rates · Guaranteed Rate · Pennymac · Bank of America · Alliant Credit Union · Wells Fargo. Best lender for a conventional mortgage? AsertaLoans was an incredible lender on the home I bought in Clearwater. I worked with Aaron and he. Mortgage brokers - these guys are pros at working deals and re-shopping till the end. They often can and will get the best deals with. Your best bet is a local lender. Ask your realtor for a recommendation. A local lender will make your offers more attractive because the local. Showing: Purchase, Good (), year fixed, Single family home, Primary residence. License information. 10 results: year fixed. The best mortgage lenders · Best for lower credit scores: Rocket Mortgage · Best for flexible down payment options: Chase Bank · Best for no lender fees: Ally Bank. You can also get a home loan through a mortgage broker. Brokers arrange transactions rather than lending money directly; in other words, they find a lender for. Churchill Mortgage is a trusted mortgage lender near you. They offer a certified home buyer program, so you close days sooner, job loss protection and. The more knowledgeable you are before you approach lenders, the better deal you're likely to get. find a mortgage lender and there is an extra fee for their. The 10 best mortgage lenders of August — and how to get their lowest rates · Guaranteed Rate · Pennymac · Bank of America · Alliant Credit Union · Wells Fargo. Best lender for a conventional mortgage? AsertaLoans was an incredible lender on the home I bought in Clearwater. I worked with Aaron and he. Mortgage brokers - these guys are pros at working deals and re-shopping till the end. They often can and will get the best deals with.

Better Mortgage Corporation is a direct lender dedicated to providing a fast, transparent digital mortgage experience backed by superior customer support. Summary: Best online mortgage lenders ; Read our Flagstar Bank review. Best online lender for FHA loans. Get Offers ; Read our Veterans United review. Best online. Foundation Mortgage is the leading mortgage lending company in Tennessee. Make the home buying process easier with Foundation Mortgage. Find out which SBA-guaranteed loan program is best for your business, then use Lender Match to be matched to lenders. Find lenders. How SBA helps small. Summary of Top Lenders · New American Funding · Rocket Mortgage · NBKC Bank · Farmers Bank of Kansas City · AmeriSave. We're an established, respected Chicago mortgage company, and our team of professionals will help you apply for a home loan and find an arrangement that works. Best for Single-Family Homes: Citibank Citibank is our choice as the best investment property lender for single-family homes because it offers a full toolbox. Sort & filter results ; Visit First Mortgage Direct site. NMLS # Bankrate Score. Rating: stars out of 5. Consumer reviews. Rating: stars. CMG Financial, , ; Columbia Credit Union, , ; Cornerstone Home Lending, Inc, , ; CrossCountry Mortgage. One way lenders can protect themselves is by offering the best terms to people who have the highest credit scores. If a lender determines that a potential. USDA Loans - USDA loans are backed by the US Department of Agriculture and designed to serve low-to-medium income families who are looking to purchase a home in. We researched customer experience, reputation, APRs, available loan types, and more from 38 leading mortgage loan lenders to find the best one. Sort & filter results ; Visit Best Rate USA site. NMLS # Bankrate Score. Rating: stars out of 5. Consumer reviews. Rating: 5 stars out of 5. A MaineHousing loan with mortgage insurance will help you buy your first home with little to no money down. Your lender will help you find the best mortgage. Discover top approved lenders for your New Hampshire mortgage at New Hampshire Housing. Get the best mortgage options for your dream home in the Granite. Licensing & Awards. Show off your Top Mortgage Lenders status with official awards and logos. Find out more. It pays shop for a lender. Learn six tips for getting quotes and comparing mortgage options to help find the home loan that's right for you. mortgage insurance or refinance your loan to get rid of it. Subscribe to the 5 of the best mortgage lenders to consider if you're buying a home in Best mortgage lenders of · NBKC Bank: Best for closing cost guarantees · Mutual of Omaha: Best for customer reputation · Rocket Mortgage: Best for borrowers. best to get mortgage ready in time to hit your goal. #3: What's the price The best lenders partner with companies like Gravy to help aspiring buyers become.

Price To Reglaze A Bathtub

Refinishing a bathtub costs between $ and $, with an average of about $ Materials may run you $30–$, while labor can be an. Bathtub Reglazing Can Save Up to 80% From Buying a New One. The Cost of the Service Depends on the Material, the Labor, and the Size of the Tub. Bathtub refinishing costs typically range from $ to $, but most homeowners will pay around $ on average. Compare that to full bathtub replacement. To refinish a tub, most homeowners spend between $ and $, with the average cost coming in at around $ If you consider all of the costs associated with. «New York Tubs» — Bathtub Reglazing (Refinishing) $ · Our specialists have 5 or more years of experience · 5-year warranty included · Superior quality at an. Reglaze a Bathtub: national average cost. The national average materials cost to reglaze a bathtub is $ per glazing, with a range between $ to $ How much should your tub resurface cost? · The average person spends about $ on their tub resurface, how about you? (HomeAdvisor) · Select a Tub Service to. Miracle Method can refinish your bathtub for a fraction of the cost. Not only can this save you up to 75% of replacement costs, but it can be completed in a. Bathtub refinishing costs $ on average, with a typical range of $ and $ This includes $30 to $ in materials and $ to $ in labor. Material and. Refinishing a bathtub costs between $ and $, with an average of about $ Materials may run you $30–$, while labor can be an. Bathtub Reglazing Can Save Up to 80% From Buying a New One. The Cost of the Service Depends on the Material, the Labor, and the Size of the Tub. Bathtub refinishing costs typically range from $ to $, but most homeowners will pay around $ on average. Compare that to full bathtub replacement. To refinish a tub, most homeowners spend between $ and $, with the average cost coming in at around $ If you consider all of the costs associated with. «New York Tubs» — Bathtub Reglazing (Refinishing) $ · Our specialists have 5 or more years of experience · 5-year warranty included · Superior quality at an. Reglaze a Bathtub: national average cost. The national average materials cost to reglaze a bathtub is $ per glazing, with a range between $ to $ How much should your tub resurface cost? · The average person spends about $ on their tub resurface, how about you? (HomeAdvisor) · Select a Tub Service to. Miracle Method can refinish your bathtub for a fraction of the cost. Not only can this save you up to 75% of replacement costs, but it can be completed in a. Bathtub refinishing costs $ on average, with a typical range of $ and $ This includes $30 to $ in materials and $ to $ in labor. Material and.

What product is used to refinish a bathtub? Bathtub refinishers use products made of polyurethane because it is durable, resistant to. From $ Bathtub Reglazing and Tile Refinishing Only give yourself a thought! What do you pay attention to when you buy a car, household appliances, or just. $ by a professional who repairs the pitting and then reglazes it. They typically specialize in this type of refinishing. Or About $ The basic cost to Reglaze a Bathtub is $ - $ per bathtub in August , but can vary significantly with site conditions and options. «New York Tubs» — Bathtub Reglazing (Refinishing) $ · Our specialists have 5 or more years of experience · 5-year warranty included · Superior quality at an. How much should your tub resurface cost? · The average person spends about $ on their tub resurface, how about you? (HomeAdvisor) · Select a Tub Service to. Refinishing a bathtub is more cost-effective than replacing it. · The average cost to refinish a bathtub is $, compared to $3, to replace it. · Refinishing. Bathtub refinishing costs $ on average, with a typical range of $ and $ This includes $30 to $ in materials and $ to $ in labor. Material and. A standard refinishing of a tub that I do is less than half the cost of those liner systems you see advertised. A Franchise which can contain royalty fees and. The cost of refinishing a bathtub is on average $ The cost of bathtub refinishing varies depending on the type of bathtub and the scope of the repair. The average costs (in the Maryland region) for bathtub refinishing are from $ to $ We invite you to request a quick estimate for your project. It's a durable, long-lasting material that restores the original shine and smooth finish to your tub. Why should I consider bathtub reglazing? The basic cost to Refinish Bathtub is $ - $ per bathtub in April , but can vary significantly with site conditions and options. You can expect to pay between $ and $ for labor costs to refinish a standard bathtub. The remaining part is the cost of materials used in the process. We offer tub reglazing, tile refinishing, bathtub repainting, and various other services. Reach out today with any questions you might have. It's a durable, long-lasting material that restores the original shine and smooth finish to your tub. Why should I consider bathtub reglazing? The typical cost to refinish a bathtub is about $ While bathtub refinishing can range in price from about $ to $, a high-end project can cost up to. Refinishing Prices · Porcelain/ Steel/ Wall tile · $ Standard bathtub white $ 3 Wall tile surround including bathtub · Minor chip repair included with. Typically, the cost of bathtub reglazing in Michigan ranges between $$ Certain conditions could cause the cost of reglazing to fluctuate slightly above. Standard size bathroom (1) in a sqft duplex. Got quoted $ for bathtub and $ more for the tile around the bathroom. Mid size bathroom. Anyone paid.

Alimony Definition

/GettyImages-1160635469-b05334731f904919a2edf1e70a71ac41.jpg)

Spousal support (also known as alimony) is a court ordered payment from one spouse or domestic partner to help cover the other's monthly expenses. The FindLaw Legal Dictionary -- free access to over definitions of legal terms. Search for a definition or browse our legal glossaries. term: Alimony. Alimony refers to the court-ordered payment(s) awarded to a spouse or ex-spouse in a divorce or legal separation agreement and is meant to provide financial. As used in this paragraph, "abuse" shall have the meaning given to it under section (relating to definitions). spousal support or alimony pendente lite. alimony and the length of time for which the alimony is awarded. defined rehabilitative plan included as a part of any order awarding rehabilitative alimony. Learn about alimony by reviewing the definition in the profhimservice62.ru Glossary. Alimony is financial support paid by one ex-spouse to the other after the marriage has legally ended. Alimony is also sometimes called spousal support. (1). "Alimony" means an order for payment for the support and maintenance of a spouse or former spouse, periodically or in a lump sum, for a specified or for an. Generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient spouse's income. Spousal support (also known as alimony) is a court ordered payment from one spouse or domestic partner to help cover the other's monthly expenses. The FindLaw Legal Dictionary -- free access to over definitions of legal terms. Search for a definition or browse our legal glossaries. term: Alimony. Alimony refers to the court-ordered payment(s) awarded to a spouse or ex-spouse in a divorce or legal separation agreement and is meant to provide financial. As used in this paragraph, "abuse" shall have the meaning given to it under section (relating to definitions). spousal support or alimony pendente lite. alimony and the length of time for which the alimony is awarded. defined rehabilitative plan included as a part of any order awarding rehabilitative alimony. Learn about alimony by reviewing the definition in the profhimservice62.ru Glossary. Alimony is financial support paid by one ex-spouse to the other after the marriage has legally ended. Alimony is also sometimes called spousal support. (1). "Alimony" means an order for payment for the support and maintenance of a spouse or former spouse, periodically or in a lump sum, for a specified or for an. Generally, alimony or separate maintenance payments are deductible by the payer spouse and includible in the recipient spouse's income.

ALIMONY meaning: money that a court orders someone to pay regularly to a former wife or husband after a divorce. - In an action brought pursuant to Chapter 50 of the General Statutes, either party may move for alimony. defined in G.S. A(3)a., during the. Alimony Payments and Duration In Connecticut And Massachusetts - R Definitions Applicable to Proceedings in Family Matters. Sec. Motions. Permanent, temporary, lump-sum, rehabilitative, and reimbursement are all types of alimony that may apply to you during a divorce. Alimony, sometimes referred to as spousal support, is the court-ordered money that one party pays to the other party for support while they are separated. The alimony definition refers to the legal obligation of the higher-income spouse to provide financial support to the lower-income spouse during a legal. An alimony payment is a periodic predetermined sum awarded to a spouse or former spouse following a separation or divorce. alimony definition could be deducted from federal income tax. The dependent spouse had to report the alimony as taxable income and pay taxes on it. However. Find the legal definition of ALIMONY from Black's Law Dictionary, 2nd Edition. The allowance made to a wife out of her husband's estate for her support. Alimony definition: an allowance paid to a person by that person's spouse or former spouse for maintenance, granted by a court upon a legal separation or a. Alimony is court-ordered support paid by one spouse to the other for a period of time after a divorce. Alimony is not necessary in every case. In Georgia, there is no formula or calculation for determining alimony. The court will weigh out the parties' "needs" vs. An experienced lawyer could help to define spousal support in New Jersey and explain the relevant statutes and case law. Alimony Definition The money paid by one ex-spouse to the other for support under the terms of a court order or settlement agreement following a divorce. The purpose of alimony is to limit any unfair economic effects of a divorce. It provides continuing income to a spouse who has little or no pay. Alimony means are subject to a number of factors, pursuant to our statute, the three most prevalent of which are the needs of the supported spouse, the ability. alimony · Financial assistance one spouse provides to the other after a legal separation or divorce · Monetary resources or aid provided for sustenance or support. When a couple gets divorced, the court might order the one spouse to pay alimony to the other, which is like an allowance for basic expenses like food and. As used in this paragraph, "abuse" shall have the meaning given to it under section (relating to definitions). spousal support or alimony pendente lite.

Whats A Cio

A CIO is a member of a company's executive team who oversees the information technology (IT) department within the organization. The 'Chief Information Officer' or CIO is the position given to the most senior individual handling the overall IT infrastructure as well as the hardware. The chief information officer (CIO) oversees the people, processes and technologies within a company's IT organization to ensure they deliver outcomes. (Leighton Johnson, ) The role of Chief Information Officer has inherent US government authority and is assigned to government personnel only. What is the. A Chief Information Officer or CIO is the person responsible for the management of technology and the usability of information within the company. A Chief Information Officer (CIO) of an organization is the highest, senior-level IT officer of an enterprise with the core responsibility of overseeing and. What is a CIO? Learn about the critical role of the Chief Information Officer and the skills and qualifications needed to maximize success at every company. A CIO, otherwise known as a chief information officer, is the executive responsible for a company's information technology strategy. Chief information officer (CIO), chief digital information officer (CDIO) or information technology (IT) director, is a job title commonly given to the most. A CIO is a member of a company's executive team who oversees the information technology (IT) department within the organization. The 'Chief Information Officer' or CIO is the position given to the most senior individual handling the overall IT infrastructure as well as the hardware. The chief information officer (CIO) oversees the people, processes and technologies within a company's IT organization to ensure they deliver outcomes. (Leighton Johnson, ) The role of Chief Information Officer has inherent US government authority and is assigned to government personnel only. What is the. A Chief Information Officer or CIO is the person responsible for the management of technology and the usability of information within the company. A Chief Information Officer (CIO) of an organization is the highest, senior-level IT officer of an enterprise with the core responsibility of overseeing and. What is a CIO? Learn about the critical role of the Chief Information Officer and the skills and qualifications needed to maximize success at every company. A CIO, otherwise known as a chief information officer, is the executive responsible for a company's information technology strategy. Chief information officer (CIO), chief digital information officer (CDIO) or information technology (IT) director, is a job title commonly given to the most.

Learn about the roles, responsibilities and job description of the chief information officer and the CIO's role in business and strategic planning What is C-. A CIO or Chief Information Officer is internally focused on the company and technology infrastructure, whereas a CTO or Chief Technology Officer is. The CIO looks for ways to make internal technology improvements, whereas the CTO is external-facing and works toward using technology to make the company more. What Is a Chief Investment Officer (CIO)? A chief investment officer (CIO) is the executive position responsible for setting the investment style and strategy. A chief information officer (CIO) is the corporate executive in charge of information technology (IT) strategy and implementation. What is a chief information officer (CIO)?; History of the information officer role (CIO); Roles and responsibilities of CIO; Qualifications for a CIO; Skills. The CIO Council is a forum of Federal Chief Information Officers (CIOs). Our goal is to improve IT practices across US Government agencies. The Chief Information Officer (CIO) is a senior executive responsible for an organization's overall technology strategy and operations. They play a vital role. Data privacy and security: A HIT CIO is responsible for ensuring patient data is secure and in compliance with healthcare regulations like HIPAA. This may. A Chief Information Officer (CIO) is a senior executive who oversees the management, implementation, and utilization of information technology (IT) within an. The CIO's role at their agency is to enable the organization's mission through the effective use of information resources and information technology. What is a CIO? A CIO manages a company's IT operations and infrastructure. They apply technological systems and products to simplify internal business. The biggest differentiator to remember is that the CIO is more focused on improving internal technology, whereas the CTO is more customer-facing and centered. The CIO is a strategic advisor, a thought leader, and a trusted confidante who is ultimately responsible for the entire organization's technology. What is a. What's the difference between the CIO and the CTO? It may not be obvious why there are different offices to lead information and technology. However, the. What is a CIO? The chief information officer (CIO) is usually the person in charge of the information technology (IT) strategy in a medium-sized business or. Meaning of CIO. Discover in the digital glossary what it is, examples and applications of the CIO in the field of digital marketing. A chief information officer (CIO) is the senior executive who uses technology and computer systems to support the organization's mission and goals. Though. A fractional chief information officer is an executive consultant who helps businesses align their information technology with their goals while staying on. CIO meaning: abbreviation for chief information officer. Learn more What is the pronunciation of CIO? Browse. cinnamon bun · cinnamon roll · cinnamon.

How To Become An Accountant With An Economics Degree

To become a qualified accountant you'll need further professional qualifications, but many accountancy roles are available to those who studied economics. In. It's easy to assume that accounting, finance and economics are very similar, and it might be confusing when thinking about which pathway to study. With a MAC degree you can solve all sorts of tax, auditing and accounting problems. Add in the insights you bring from your economics background, and you've. 1. Economist · 2. Actuarial Analyst · 3. Data Analyst · 4. Statistician · 5. Investment Analyst · 6. Stockbroker · 7. Chartered Accountant · 8. External Auditor. The first step is to prepare with a well-rounded education. Besides accounting and business courses, plan on taking additional courses in finance, management. Some of this additional coursework can be completed at UMBC. Master's degrees in accounting are offered at the University of Maryland College Park, the. Requirements: · semester hours of bachelor's, or typically, higher credit hours · Some states require at least one year of accounting experience · Pass the. 1. Accountant. What you'd do: Accounting is one of the better-known jobs for economics majors. Accountants prepare and examine financial records, ensuring. A degree in Economics will equip you with sophisticated numerical and analytical skills – perfect for exploring an accountancy role. Accountants work in all. To become a qualified accountant you'll need further professional qualifications, but many accountancy roles are available to those who studied economics. In. It's easy to assume that accounting, finance and economics are very similar, and it might be confusing when thinking about which pathway to study. With a MAC degree you can solve all sorts of tax, auditing and accounting problems. Add in the insights you bring from your economics background, and you've. 1. Economist · 2. Actuarial Analyst · 3. Data Analyst · 4. Statistician · 5. Investment Analyst · 6. Stockbroker · 7. Chartered Accountant · 8. External Auditor. The first step is to prepare with a well-rounded education. Besides accounting and business courses, plan on taking additional courses in finance, management. Some of this additional coursework can be completed at UMBC. Master's degrees in accounting are offered at the University of Maryland College Park, the. Requirements: · semester hours of bachelor's, or typically, higher credit hours · Some states require at least one year of accounting experience · Pass the. 1. Accountant. What you'd do: Accounting is one of the better-known jobs for economics majors. Accountants prepare and examine financial records, ensuring. A degree in Economics will equip you with sophisticated numerical and analytical skills – perfect for exploring an accountancy role. Accountants work in all.

For more information, see the: AICPA webpage, and; The New York State Office of the Professions. Requirements for Students Declaring the Accounting Major. Students can qualify to take the CPA Exam after completing AT LEAST: semester hours of college or university coursework that must include courses in. Economics Major Requirements · ECON Principles of Economics · ECON Statistics · ECON Microeconomics · ECON Macroeconomics · ECON Quantitative. However, if a learner does not wish to take graduate courses, he/she may meet the requirements to sit for the CPA exam by taking additional undergraduate. They may work for an accounting firm or on a freelance basis. Tax accountants must have at least a bachelor's degree in finance or a related field is preferred. My CMC accounting degree gave me the foundation I needed to run my own CPA firm a few years after graduating. I also attended law school; I will be graduating. Job options · Actuary · Chartered public finance accountant · Compliance officer · Data analyst · Economist · Financial manager · Financial risk analyst · Internal. Careers in Economics, Finance, and Accounting · Forensic Accountant · Fraud Investigator · Internal Revenue Service Agent · Tax Specialist. Earning bachelor's degrees in economics allows graduates to pursue careers as statisticians, financial advisors, and financial analysts. This degree teaches. You'll prepare and examine financial statements, manage budgets, and ensure compliance with tax laws. With an economics degree, you can become an accountant and. In some cases, an economics degree could get you an accounting job right away. However, you will need to prove yourself to employers as a viable employer. Pursue economics if you want to be challenged and enlightened. Pursue accounting if you want to be paid. The combined economics/accounting major is designed to integrate the most important aspects of economic theory and accounting practice to provide the foundation. What jobs can you get with an Accounting, Finance or Economics degree? As a personal accountant, your job would be to manage the accounts of. A bachelor's degree in public accounting and business management can open many doors for you within business, including opportunities in financial and tax. The only thing that might be difficult is the fact that to become an accountant you will need to pass a licensing exam before you can start working. In. This accredited economics degree is designed for anyone who wants to pursue a career in accountancy, finance or banking. “Commercial bank or investment firms often look for candidates with an economics degree even for non-economist jobs, not because finance and economics are the. What Kind of Jobs Do You Get? · Economist. Economists are responsible for collecting and analyzing data in order to research and predict trends. · Accountant or. However, they aren't qualified to work as accountants because they haven't learned the methods that accountants use to balance budgets and record expenses.

Citi Pre Selected Offer

Pre-Qualified · Citi Shop · Respond to Mail Offer. Banking. Banking. Checking Bonus Offer2. Citi® / AAdvantage Business™ World Elite Mastercard®. Citi. Some issuers, such as American Express, send mailers to potential customers with limited-time offers for which they have been preselected. Others, such as Chase. Good news, you're pre-qualified. We found 1 credit card offer available if you apply here today. Offers may vary and may not be available in other places. Offers may differ from time to time and depend on the marketing channel, such as phone, email, online, direct mail, or in branch. You must select Apply Now on. If you're approved for an eligible balance transfer card with Citi, then you just need to select a balance transfer offer. You can also fill out Citi's pre. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit profhimservice62.ru to. Citibank no longer offers a prescreening and pre-qualification process that allows you to see whether or not you'll be preapproved for a Citi credit card. Offers may vary and this offer may not be available in other places where the card is offered. Hear what real cardmembers have to say. Good news, you're pre-qualified It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the. Pre-Qualified · Citi Shop · Respond to Mail Offer. Banking. Banking. Checking Bonus Offer2. Citi® / AAdvantage Business™ World Elite Mastercard®. Citi. Some issuers, such as American Express, send mailers to potential customers with limited-time offers for which they have been preselected. Others, such as Chase. Good news, you're pre-qualified. We found 1 credit card offer available if you apply here today. Offers may vary and may not be available in other places. Offers may differ from time to time and depend on the marketing channel, such as phone, email, online, direct mail, or in branch. You must select Apply Now on. If you're approved for an eligible balance transfer card with Citi, then you just need to select a balance transfer offer. You can also fill out Citi's pre. Terms apply to American Express benefits and offers. Enrollment may be required for select American Express benefits and offers. Visit profhimservice62.ru to. Citibank no longer offers a prescreening and pre-qualification process that allows you to see whether or not you'll be preapproved for a Citi credit card. Offers may vary and this offer may not be available in other places where the card is offered. Hear what real cardmembers have to say. Good news, you're pre-qualified It does not, and should not be construed as, an offer, invitation or solicitation of services to individuals outside of the.

Pre-Qualified · Citi Shop · Respond to Mail Offer. Banking. Banking. Checking Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals. Citi Credit Knowledge Center; See if you're Pre-Qualified; Citi Shop; Respond to Mail Offer. Banking. Banking Overview · Checking · Savings · Certificates of. Does Citi Offer Pre-Qualification Before Applying? Citibank provides a Citi Merchant Offers are select deals and savings offered to select Citi credit. Apply today and discover the benefits your new card has to offer select "Reject Cookies", as essential cookies are required for our site to perform. If you're offered prescreening, that means you conditionally meet the approval criteria for the credit card when you formally apply. These prescreens can arrive. Internal Audit does just that for key business areas at Citi, offering you Qualified applicants will receive consideration without regard to any. Citi Prestige® Card · Commerce Bank® World Elite Mastercard® · Delta SkyMiles You have been selected to participate in a brief survey about your. Use your Citi® card to access presale tickets and exclusive experiences to music, sports, arts and cultural events. Great for a long balance transfer offer. Learn more about this card's perks and benefits in our editors' full review. Citi and Chase. Will CardMatch™ impact my credit? Nope! While we'll run a soft credit pull to determine which cards you're likely to qualify for, this is a. Your purchase offer is backed by a SureStart® commitment, giving you an edge over other buyers without a firm pre-approval commitment. View Citi® / AAdvantage® Credit Card offers. Our American Airlines travel credit card benefits include bonus miles and many other rewards. Learn more. How to pre-qualify for a credit card · What is a fair credit score? Moving Citi® / AAdvantage® Platinum Select® World Elite Mastercard® logo. ( offers. That's because some companies may have gotten your information before the site processed your opt-out request. Opting out will not stop all. citi. discover. wells-fargo. bank-of-america. credit-one-bank. See the online credit card applications for details about the terms and conditions of an offer. Check for pre-approved & pre-qualified credit card offers from all of the major credit card issuers (American Express, Bank of America, Capital One, Citi. The most complete list on soft pull pre-qualified credit card offers on the internet, we cover banks to credit unions for rebuilding credit &. Get Email Offers · Customer Service; US United States(expand to select country/region). Select country/region: United States · Canada · United Kingdom · Mexico. Pre-Qualified · Citi Shop · Respond to Mail Offer. Banking. Banking. Checking Special Travel Offer: Earn an additional 4% cash back on hotels, car rentals. Whether you're pre-qualified or preapproved, you're not guaranteed approval. A glaring exception from the above list is Citi, which will not allow you to.